Tax deductions for rideshare (uber and lyft) drivers – get it back: tax How to fill out irs schedule e, rental income or loss What is a schedule 1 tax form?

Tax Deductions for Rideshare (Uber and Lyft) Drivers – Get It Back: Tax

2010 form 1040 (schedule e) Schedule e Uber deductions rideshare expenses deduction lyft claim expense

Where do i enter schedule c?

Schedule eTurbotax enter income taxes self refund Schedule income loss who when supplemental completeSchedule rental income irs loss fill.

Schedule 1040 sch studylib tax supplemental .

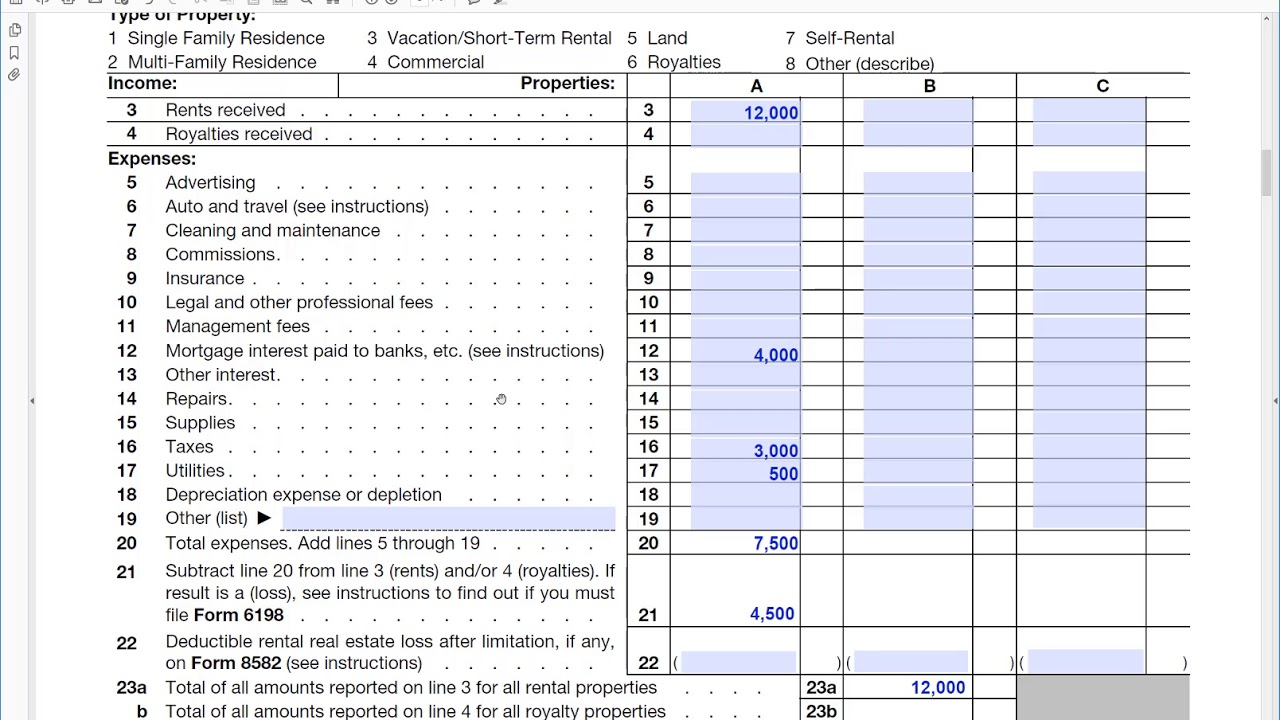

How to fill out IRS Schedule E, Rental Income or Loss - YouTube

2010 Form 1040 (Schedule E)

SCHEDULE E - SCHEDULE E(Form 1040 Department of the Treasury Internal

Schedule E - "What", "Who", "When" and "How" - The Usual Stuff

Tax Deductions for Rideshare (Uber and Lyft) Drivers – Get It Back: Tax

Where Do I Enter Schedule C? | Turbo Tax